estate tax return due date canada

On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death. The estate T3 tax return reports income earned after death.

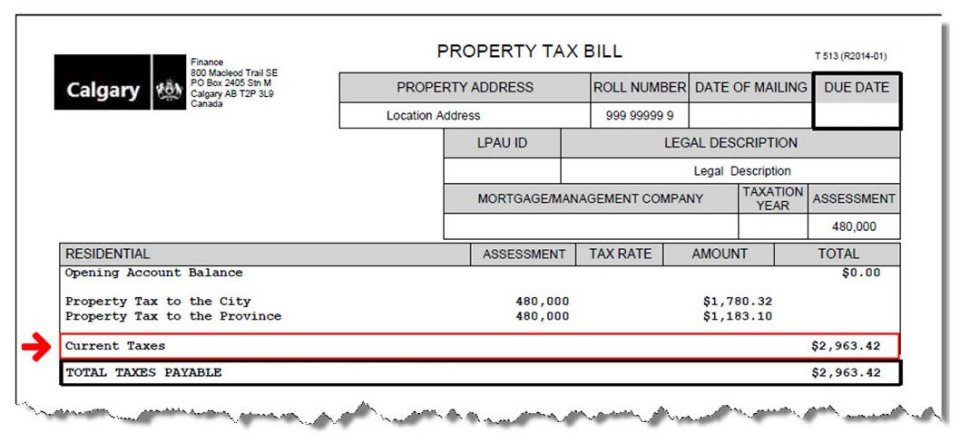

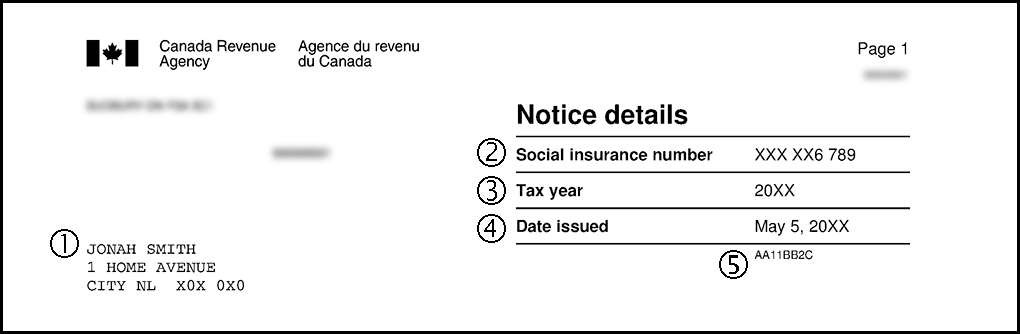

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross.

. The personal representative of the testator must ensure that income tax returns have been properly filed for the year preceding death and that any income earned between. This return is due at the same time as the terminal tax return. Report income earned after the date of death on a T3 Trust.

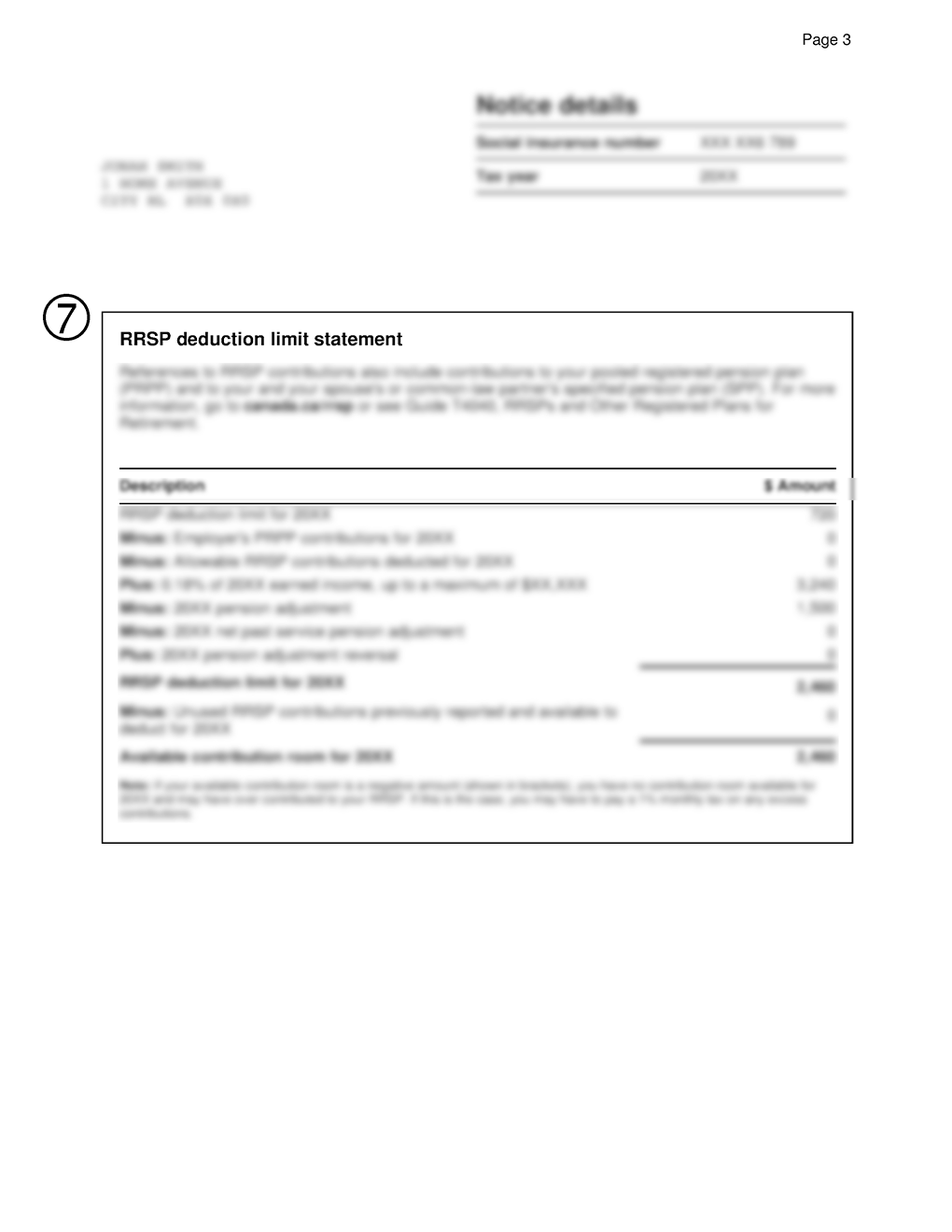

For a T3 return your filing due date depends on the trusts tax year-end. In general an estate must pay quarterly estimated income tax in the same manner as individuals. Filing due date is April 30 for most taxpayers June 15 for self-employed and may vary for a deceased persons return Payment due date for 2021 taxes Pay your balance owing.

Learn How EY Can Help. If the death occurred between january 1 and october 31 inclusive the due date for the final return is april 30 of the following year. First there are taxes on income or on.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Form 1120 for C-Corporations 18th April 2022. How to complete the final return Step 1 Identification and other information Step 2 Total income Step 3 Net income Step 4 Taxable income.

You have to file the T3 return no later than 90 days after the trusts tax year-end. Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs. To get a clearance certificate as quickly.

What is the due date for a balance owing. In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4. Only about one in twelve estate income tax returns are due on April 15.

Note that the T3 filing deadline is 90 days after the year-end chosen by Rita. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension. Estate Trust Tax Services.

Form 1041 for Trusts and Estates 18th April 2022. The estate T3 tax return reports income earned after death. If the death occurred between January 1 and December 15 inclusive the due date for the final return is June 15 of the following year.

If the filing due date falls on a Saturday a Sunday or a public holiday recognized by the CRA we will consider. The gift tax return is due on April 15th following the. Form 990 Series for Tax-Exempt Organizations 16th.

The types of taxes a deceased taxpayers estate. 13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706. For more information on when estimated tax payments are required see the.

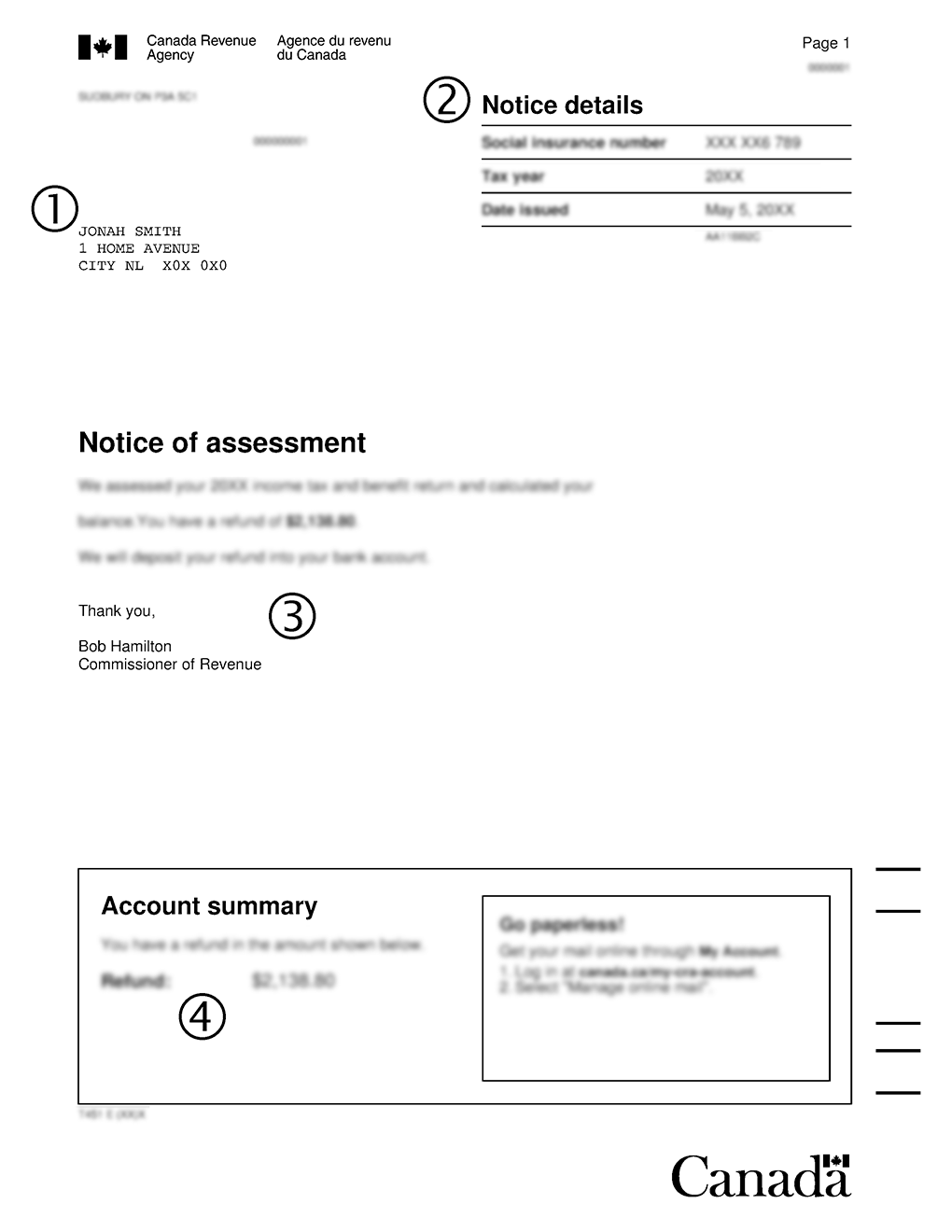

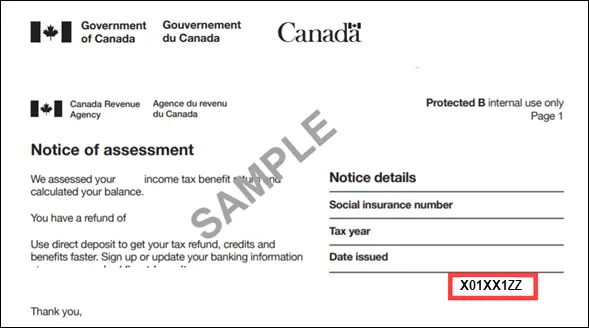

Filing dates For a T3 return your filing due date depends on the trusts tax year-end. 1- Notify the Canada Revenue Agency of the death 2- File the necessary tax returns 3- Obtain notices of assessment 4- Pay or secure all amounts owing What you need to. The Return for Rights or Things is due by the later of one year from the date of death or 90 days after the mailing date of the Notice Of Assessment NOA for the final return.

For example if the estate is wound up and. If the death occurred between December 16 to. 18th April 2022.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Tax Deadline 2023 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

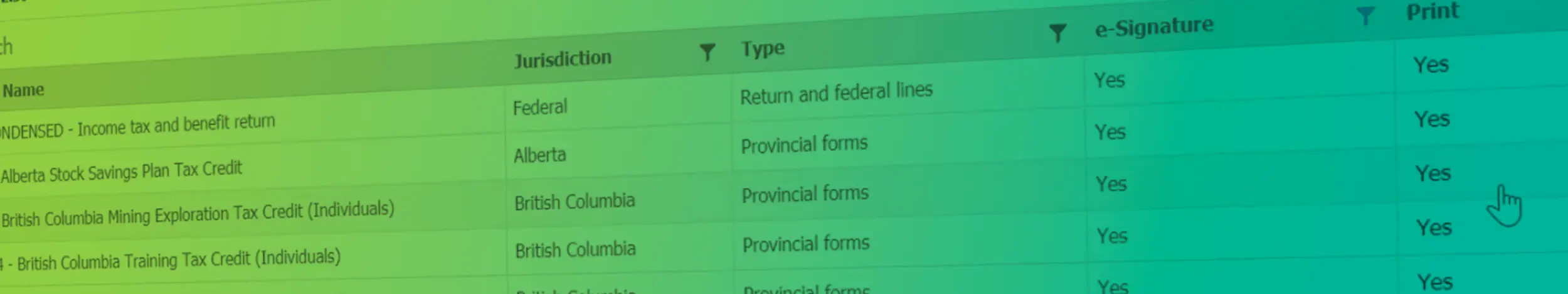

New Automatic T183 Date And Timestamp Feature Saves Time Wolters Kluwer

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Everything You Need To Know About Netfile H R Block Canada

10 Limitation Period For Collections Of Tax Debt By Cra

Check These Tax Filing Deadlines Off Your To Do List

Money Dates 2019 Ativa Interactive Corp Dating Personals Dating How To Plan

Tax Deadline 2023 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Canadian Tax Return Deadlines Stern Cohen

Download Rental Home Inspection Checklist Templatelab Com Inspection Checklist Home Inspection Being A Landlord

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes

January 2021 Ssi Payment Calendar Social Security Benefits Disability Payments Social Security Disability Social Security Benefits

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca